Finance

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

RAPID CITY, S.D. — Walt Swan Jr. says his “ugly mug” adorns the front of the South Dakota Economic Impact Report from Google because of advice he received from the Four Bands Community Fund.

- Details

- By Joe Boomgaard

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

MINNEAPOLIS, Minn. — A venture capital firm founded to invest in Black, Latinx and Indigenous technology startups has partnered with three tribes to create equity financing solutions that fit with tribal values.

- Details

- By Mark Fogarty

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

A Utah tribe that owns a mortgage banking agency is promoting down payment assistance as a way of boosting the volume of home loans among American Indians and all minorities.

- Details

- By Joe Boomgaard

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

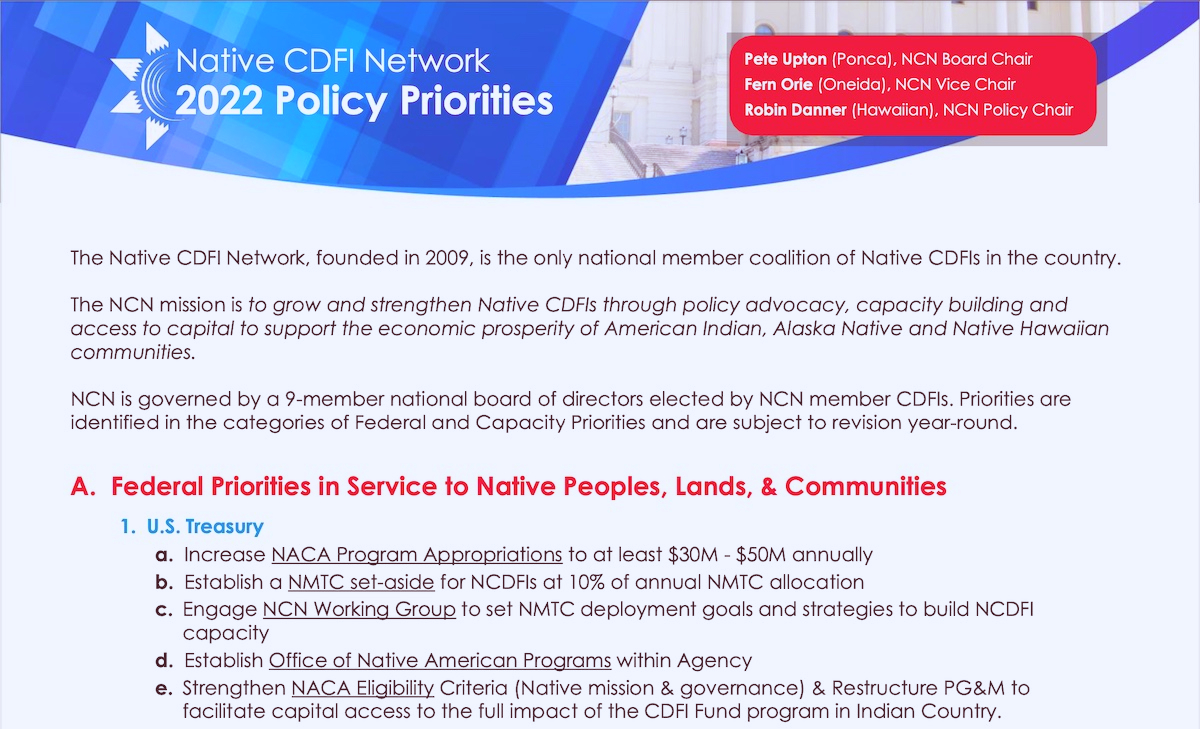

Fresh off the heels of a “huge win” in the spending bill this month, the national trade group representing Native community development financial institutions aims to keep the momentum going with a focus on increasing the visibility of the industry.

- Details

- By Mark Fogarty

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Although they’re often a complicated maze of programs, housing trust funds can serve as a key piece of the funding pie as American Indian tribes seek to develop affordable housing.

- Details

- By Chez Oxendine

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

TUBA CITY, Ariz. — Native American entrepreneurs face a chronic lack of access to capital. Whether it’s the lack of banks on reservation lands, a lack of eligible land as collateral, or a disconnect between Natives and traditional investors, many aspiring business people in Indian Country cannot access capital in the same way as less marginalized communities.

- Details

- By Mark Fogarty

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

Financing housing in Indian Country is complicated. It usually involves several sources of funding and even then, tribes or developers might come up a little short or have expenses come in higher than expected.

- Details

- By Joe Boomgaard

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

HALES CORNER, Wis. — A Wisconsin-based Native community development financial institution is leveraging grant funding to create new products that serve what it sees as a coming wave of new tribal enterprises in the next few years.

- Details

- By Mark Fogarty

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

While the numbers of mortgages extended to Native Americans jumped in 2020 as home refinancings boomed during a year of low interest rates, their share of total loans went down, Home Mortgage Disclosure Act data show.

- Details

- By Chez Oxendine

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: No Question

Cherylin Atcitty opened the BlueRoan Gallery in Taos, New Mexico just prior to COVID-19 spreading across the United States. While she initially planned to sell products that she and her family made, Atcitty quickly expanded the concept to include arts and craft work from other Native American creators.