- Details

- By Chez Oxendine

- Native Contracting

The Senate Committee on Small Business and Entrepreneurship met Wednesday to examine fraud and oversight in Small Business Administration programs and federal contracting, with lawmakers sharply divided over the scope of abuse.

The hearing covered pandemic-era loan fraud, SBA lending to luxury businesses and the 8(a) federal contracting program, which has become a critical contracting pathway for many Native-owned enterprises.

During the hearing, lawmakers and witnesses offered sharply different views on whether the program requires structural reform, more targeted oversight or outright termination.

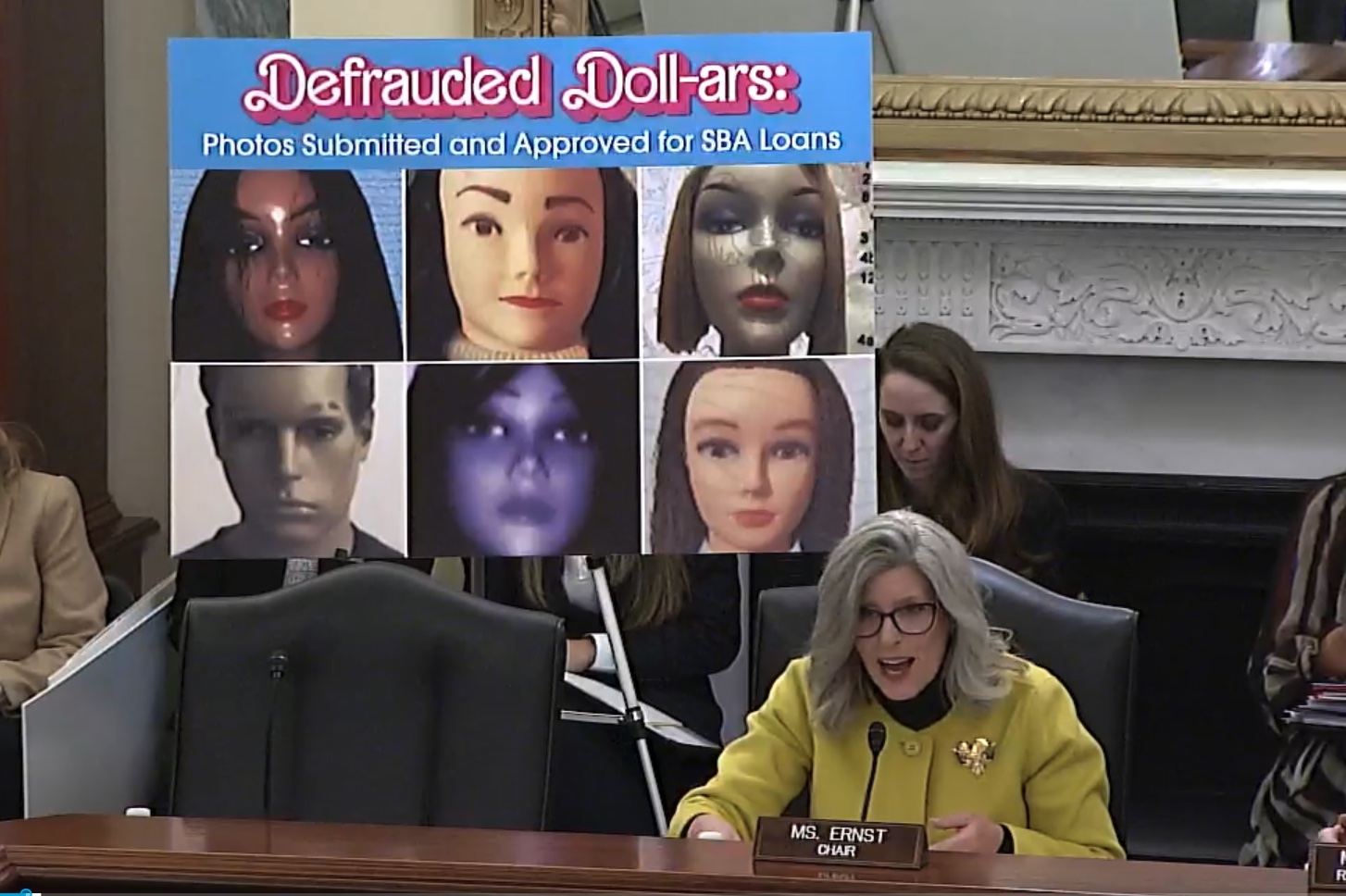

Committee Chair Sen. Joni Ernst (R‑Iowa) opened the hearing by highlighting examples of pandemic-era fraud she described as “too outrageous to believe,” including PPP loans for applicants who used pictures of Barbie dolls as identification and loans approved for borrowers who claimed to be over 115 years old.

She also cited a recent prosecution in which a USAID contracting officer was convicted of taking more than $1 million in bribes to steer more than $550 million in contracts to 8(a) participants. Ernst argued that the SBA program has long attracted abuse and said she has introduced legislation to pause all 8(a) sole‑source awards until SBA completes a full audit.

“Government contracting should be based on eligibility and merit, not skin color,” Ernst said, adding that fraud in federal programs “hurts all our small businesses the most.”

Ranking Member Sen. Edward Markey (D-Mass.) countered that the administration’s broader approach to small business policy has already harmed women‑, minority‑ and veteran‑owned firms. He defended the 8(a) program as a bipartisan tool dating back to the Nixon administration that has expanded opportunities for disadvantaged entrepreneurs.

“This program has opened doors for communities that have been shut out of federal contracting for generations,” Markey said. “The little guys are not the villains.”

Sen. Mazie Hirono (D‑Hawaii) echoed the sentiment. She warned that broad claims of fraud risk overshadowing the program’s long record of supporting Native economies, including Native Hawaiians.

Hirono said the 8(a) program includes entity-owned businesses — primarily Alaska Native corporations, Native Hawaiian organizations and tribal enterprises — that “hire thousands of people, giving back to communities.” She accused Ernst of targeting Native businesses with her call to pause the program.

“Native Hawaiian organizations rely on this program to build capacity and create jobs at home,” Hirono said. “We should not take isolated cases of fraud and use them to undermine an entire system that has helped disadvantaged communities for decades.”

Sen. Jon Husted (R-Ohio) pressed witnesses on whether set‑aside programs were being used as pass‑throughs for larger firms. He recounted a conversation with a contractor in the aggregate and asphalt business who said 8(a) firms simply “bring their trucks here, fill them up with my stuff, mark up the price and then deliver it to the same place that I would.”

The witnesses offered differing assessments of the program’s vulnerabilities. Luke Rosiak, an investigative reporter for The Daily Wire, described 8(a) contracting as “the most openly abused and shockingly corrupt program in the federal government.” He argued that set‑asides have drifted far from their original purpose and now enable large federal contractors to bypass competition by routing work through smaller 8(a) firms.

Rosiak specifically criticized Alaska Native corporations, claiming “there are skyscrapers down the street in Tyson's Corner, defense contractors working on advanced weapons that don't have to bid competitively for contracts because we say they're Alaskan Native corporations. Every one of us in this room knows there are not Native Alaskans in those buildings.”

“The scandal isn’t that there have been a few examples of abuse,” Rosiak said. “The scandal is that it’s hard to find one that isn’t.”

Dylan Hedtler‑Gaudette, acting vice president at the Project on Government Oversight, urged lawmakers to keep the program in perspective. He noted that 8(a) contracts account for just over 5% of federal contracting dollars and argued that Congress should prioritize oversight where the financial risk is greatest.

“Oversight bandwidth and resources are extremely finite,” he said. “We need to triage those resources and focus on the most egregious and the largest examples of waste, fraud and abuse.”

When Hirono asked Hedtler-Gaudette whether the 8(a) program is “fraught with rampant fraud and abuse,” he responded: “No, no.”

Two additional witnesses broadened the discussion beyond the 8(a) program. John Hart, chief executive of transparency advocacy group OpenTheBooks, highlighted government‑wide waste, citing inflated federal salaries, pandemic loan fraud and SBA‑backed loans flowing to luxury businesses. Hart cited more than $105 million in SBA loans to private country clubs, beach clubs, tennis and racket clubs and yacht clubs since 2023, with nearly half approved in 2025 alone.

Dr. Courtney LaFountain, acting director at the Government Accountability Office, focused on lessons from SBA’s pandemic‑era programs. She said the rush to deliver aid “came at the expense of oversight and fraud risk management,” but noted that stronger controls have since saved the government an estimated $30 billion.

She and Hart both urged SBA to expand data analytics and strengthen post‑award monitoring, potentially with the aid of artificial intelligence.

Ernst entered into the record a statement from Sen. Dan Sullivan (R-Alaska), who is not a member of the committee and was not present at the hearing. Sullivan, a retired Marine Corps officer, defended the 8(a) program as critical to national security, citing statements from multiple Defense Department leaders who told him the program helps deliver capabilities faster than traditional large contractors.

Sullivan argued that Native participation in 8(a) “is not a DEI initiative or race-based affirmative action” but rather “grounded in Congress’s explicit recognition of the political and legal status of American Indians, Alaska Natives and Native Hawaiians.” He said SBA Administrator Kelly Loeffler confirmed in writing that a recent executive order targeting diversity programs does not apply to Native programs.

“This is about self-determination, not race,” Sullivan wrote.

The hearing followed a 22-letter campaign issued by Ernst to federal agency leadership in recent weeks. Many of the letters called into question tribal compliance with 8(a) programs, prompting pushback from tribal leaders and Native enterprises that said the allegations relied on incomplete or incorrect information. Several companies told Tribal Business News they were not contacted before being named in Ernst’s correspondence.

While Native visitors, including contracting officials, were present in the gallery during the hearing, none were invited as witnesses.

Brian Edwards provided additional reporting.