Finance

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

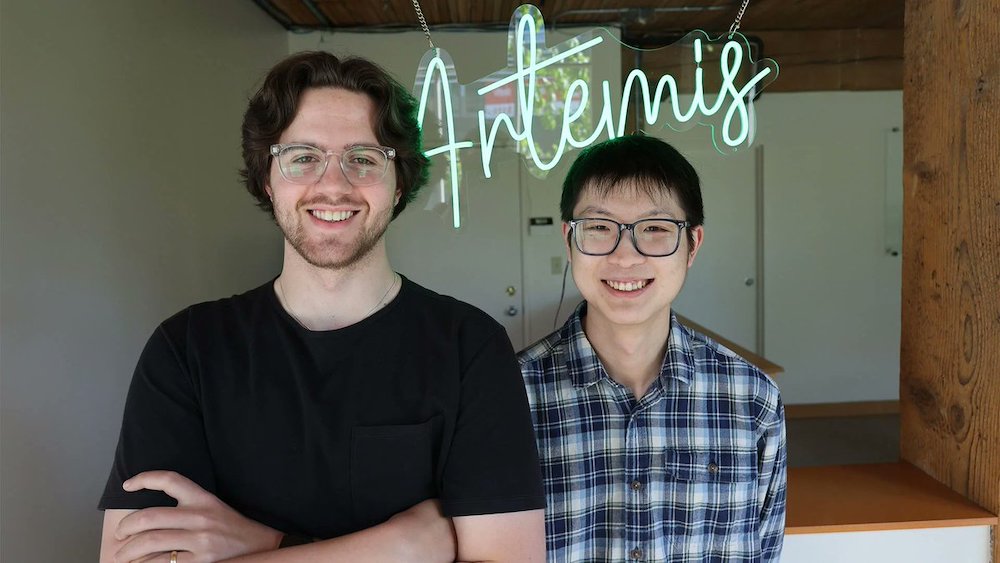

Artemis, a Vancouver-based technology company led by Indigenous co-founder Josh Gray, has secured $1.5 million in pre-seed funding to simplify data preparation and automate data cleaning for businesses.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

In a move hailed as a "significant step forward,” U.S. Reps. Gwen Moore (D-WI) and David Schweikert (R-AZ) introduced the bipartisan Tribal Tax and Investment Reform Act on Wednesday.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: No Question

This week, the Native CDFI Network and Tribal Business News are launching a yearlong podcast series highlighting how Native community development financial institutions (CDFIs) work alongside their small business clients to accelerate change and create economic opportunities in Native communities.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

The Chickasaw Nation announced the establishment of Pennington Creek Capital, a private capital investment firm set to open an office in Dallas, Texas.

- Details

- By Chez Oxendine

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: No Question

LAS VEGAS — The United States Treasury announced a new round of approvals for tribal support under the State Small Business Credit Initiative (SSBCI), a 2010 program aimed at helping open new avenues to credit by supporting funding institutions.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

A settlement between the state of Colorado and Kansas-based debt collector TrueAccord will refund $500,000 to borrowers who defaulted on loans issued by tribal lending entities.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

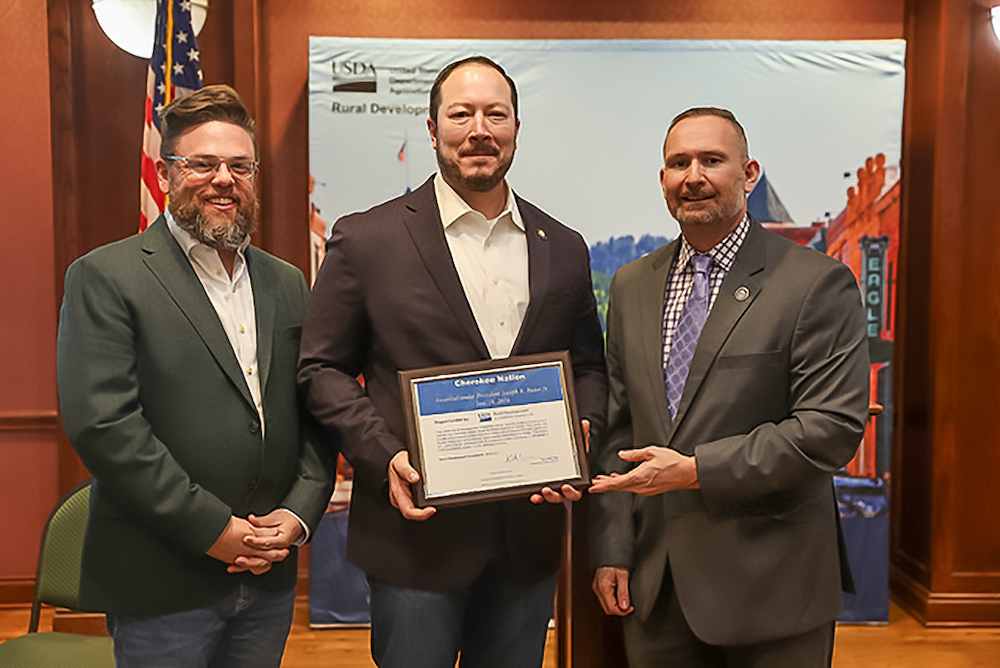

The Cherokee Nation said it received a $500,000 grant from the Department of Agriculture’s Rural Development agency in support of Cherokee citizen-owned small businesses.

- Details

- By Brian Edwards

- Finance

- Type: Default

- Paywall Status: Protected

- Reader Survey Question: Business Topics

The Navajo Nation said it received notice Friday that it was awarded $88.7 million through the Treasury's State Small Business Credit Initiative (SSBCI) program.

- Details

- By Tribal Business News Staff

- Finance

- Type: Default

- Paywall Status: Free

- Reader Survey Question: Business Topics

Here are 11 of our most-read Tribal Business News stories this year about access to capital in Indian Country.

- Details

- By Chez Oxendine

- Finance

- Type: Headshot

- Paywall Status: Protected

- Reader Survey Question: Business Topics

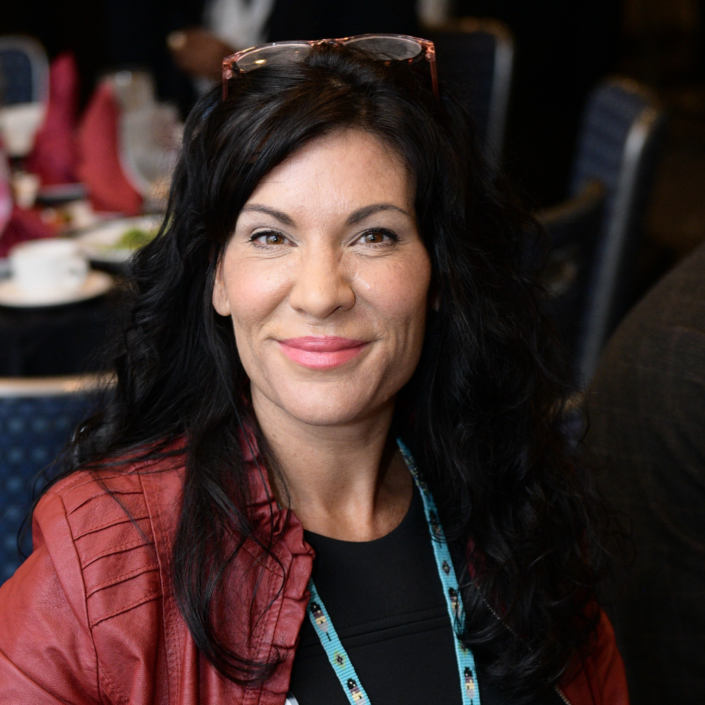

New changes introduced by the Treasury’s Community Development Financial Institution (CDFI) Fund could “pose several challenges” for Native CDFIs, says Oweesta Corporation’s CEO Chrystel Cornelius. But there is also some upside, she adds.