- Details

- By Chez Oxendine

- Real Estate

The Department of Housing and Urban Development (HUD) said during the White House Tribal Nations Summit this week that it would finalize the new rules for the Section 184 loan guarantee program in 2024, with a focus on modernization, fee reduction, and increased support for Native communities.

The new rules aim to modernize the program by codifying programmatic requirements, establishing a minimum level of lending on trust lands, and improving guarantees to pull more lenders into the program.

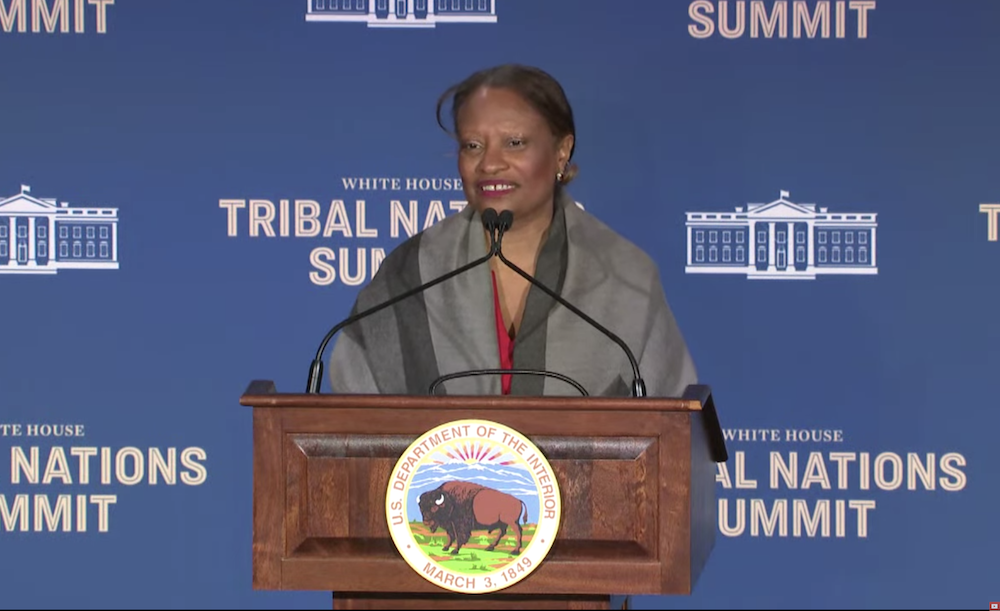

The changes follow “extensive” tribal consultations and were aimed specifically at pain points tribes identified as especially vulnerable, HUD Deputy Secretary Adrianne Todman said during remarks at the summit.

“I know I’ve heard in my travels throughout the country that sometimes Section 184 isn’t the easiest program to try to use,” Todman said. “This new rule will encourage greater lender participation, encourage more loans on trust land, and improve our administration of this very important program.”

Native housing has become a crisis on many reservations, between supply shock on construction materials brought on by COVID-19 and a growing need that outstrips yearly builds, per prior Tribal Business News reporting. In a June story, correspondent Mark Fogarty wrote that Indian Country needed around $50 billion — and an estimated 125,000 more housing units built across tribal nations — to solve its housing crisis.

For reference on the funding front, Todman reported during this week’s Summit that the Biden administration has, so far this year, funneled roughly $4 billion in funding into the problem.

“We know that having a place to call home is foundational to our success, our sense of safety and our stability, and even our health. That is why this administration is so focused on providing funding, technical assistance, and leadership to help families find housing they can afford,” Todman said, citing “historic” levels of funding for Native housing under the Biden administration.

Direct funding isn’t the only issue. Lender participation in the Section 184 program has been “negligible” and none of the three largest mortgage lenders in the country participate in the Section 184 program according to a new report by the National Community Reinvestment Coalition. Just 2,200 loans each year have been made under the program, the report on financial inaccessibility called “Redlining the Reservation.”

Attracting investors and lenders to support tribal housing projects and mortgages has been slow, as has been the flow of low-cost, long-term capital for Native lenders according to Pete Upton, the CEO of a national association that supports Native community development financial institutions (CDFIs), which make mortgage and other loans.

“The number one challenge that Native CDFIs face in helping people get homes is lack of capital — we can't be lenders without the appropriate capital,” Upton said during a June 2023 Senate hearing on housing in Indian Country. “You're inviting us to a game that we can't play.”

The 1992 Housing and Community Development Act introduced the HUD 184 Indian mortgage, 100% insured by the federal government. Lending didn’t start in the program until 1995, but as of November 2018, $7.2 billion of lending had been done through 42,766 loans. Much of the lending turned out to be off-reservation, though a fair amount of it was in border areas outside reservation boundaries.

HUD has made changes to the program to make it more attractive to homeowners, including lower fees, which in turn should save “thousands of dollars for the average borrower,” HUD’s Todman said during her presentation at the summit.

With reduced fees, a Section 184 borrower purchasing a $194,000 home would save approximately $500 in the first year and up to $6,800 over the term of the loan with the change in fee structure, according to HUD. In addition to the savings to borrowers, the lower fees help more people qualify for a mortgage.