- Details

- By Chez Oxendine

- Energy | Environment

A tribal power authority has created the first handbook for tribes navigating millions in unclaimed renewable energy tax credits, stepping outside its normal role to solve a critical knowledge gap in Indian Country.

The new guide, developed by the Oceti Sakowin Power Authority (OSPA) in collaboration with the U.S. Department of Energy (DOE) and accounting giant Deloitte, addresses confusion surrounding direct pay tax credits that renewable energy experts call “game-changing.”

The Inflation Reduction Act established these direct pay credits and made tribes eligible to claim them despite being tax-exempt. However, few tribes have adopted the credits. According to prior Tribal Business News reporting, only one major project — a carport solar project by the Viejas Band of Kumeyaay Indians in California — has announced using the credits in its financing.

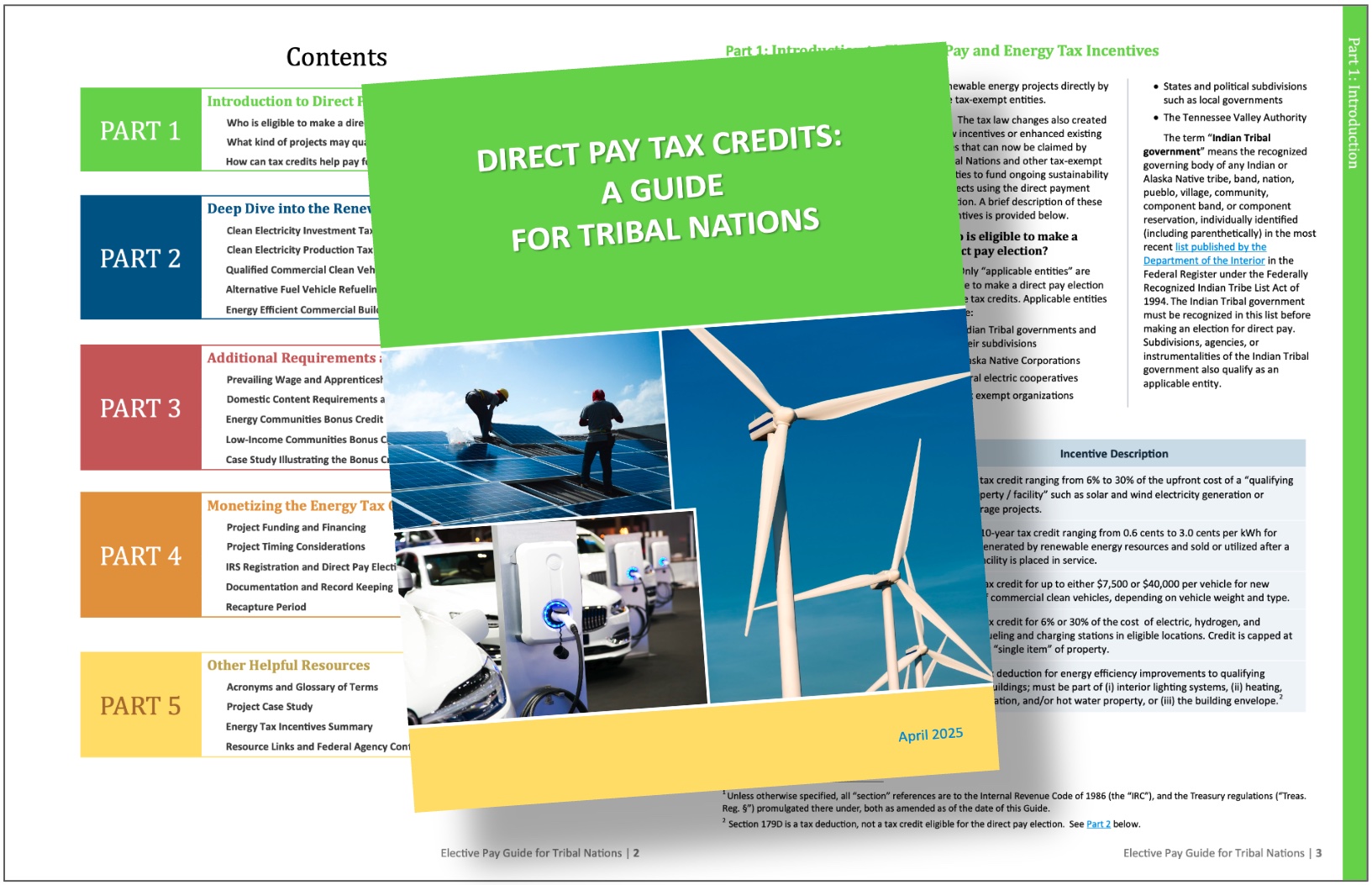

OSPA representatives said many tribes aren’t aware these credits are available or believe they are ineligible due to tax-exempt status or project grants. The free handbook, “Direct Pay Tax Credits: A Guide for Tribal Nations,”addresses these misconceptions. For example, projects with partial grant funding can still access the tax credits for remaining project costs.

The handbook covers using tax credits in project financing, including attracting private capital alongside other funding sources. It also details available credits, such as those for projects targeting low-income communities or for projects using domestically purchased materials in construction.

“There’s a general lack of awareness. Even among those who do know about them, there’s confusion,” Caroline Herron, project director for OSPA, told Tribal Business News. “There’s a widespread need for better education on this topic.”

Jon Canis, general counsel for OSPA, said the organization reached out to tribes like the Shakopee Mdewakanton Sioux Community, the Oneida Nation, and the Seminole Nation, finding that none had fully explored or committed to utilizing the tax credits.

OSPA's Caroline Herron (left) and Jon Canis (right), who spearheaded the tax credit guide. "Everyone was essentially waiting to see who would take the first step," Canis said of tribal hesitation to utilize the credits. (Courtesy photos)

OSPA's Caroline Herron (left) and Jon Canis (right), who spearheaded the tax credit guide. "Everyone was essentially waiting to see who would take the first step," Canis said of tribal hesitation to utilize the credits. (Courtesy photos)

“Everyone was essentially waiting to see who would take the first step, and there was a lot of uncertainty,” Canis said. “There was widespread awareness that this could be a game-changer, but no one had made the move yet.”

The DOE funded the handbook with a grant after seeing slow adoption of the IRA tax credits among tribes. The department approached OSPA, which typically develops utility-scale renewable energy projects for its seven member tribes, to leverage its experience with production tax credits and its understanding of tribal needs, Herron said.

“Writing a white paper isn’t something OSPA normally does—we focus on development work for the tribes in our organization—but the DOE saw that we had both tribal perspective and practical experience with production tax credits for utility-scale wind projects,” Herron said. “That positioned us well to help tribes understand the advantages of these tax credits.”

Deloitte offered its expertise pro-bono, Canis said, enabling the collaboration on the comprehensive guide.

“By the time the funding opportunity announcement for the grant was released, we were in a strong position to start developing this guide,” Canis said.

The handbook provides tribes seeking energy sovereignty a roadmap for accessing tax credits worth up to 70% of project costs. It explains how tribal nations can qualify for, document, and monetize these credits while maintaining full ownership of their renewable energy infrastructure—from utility-scale wind farms to community solar projects—without ceding control to outside investors.

By addressing IRS requirements, bonus credit opportunities, and financing structures, the guide tackles specific barriers that have limited tribal participation in clean energy development. These tax incentives offer tribes tools for reducing energy costs, creating jobs, and building energy independence on their lands.

Beyond the handbook, the DOE grant has allowed OSPA to begin creating classes in conjunction with Deloitte on the tax credit programs. These will initially serve OSPA’s member tribes, before expanding to other interested tribes, Herron said.

“We definitely see it expanding beyond our seven tribes,” Herron said. “DOE doesn’t intend to limit outreach.”