- Details

- By Joe Boomgaard

- Finance

Fresh off the heels of a “huge win” in the spending bill this month, the national trade group representing Native community development financial institutions aims to keep the momentum going with a focus on increasing the visibility of the industry.

The omnibus package that President Biden signed into law earlier this month included a 30-percent increase in the Native American CDFI Assistance (NACA) program. The bill allocates $21.5 million to the NACA program after years of hovering at the $16 million to $16.5 million mark.

Pete Upton, chair and interim director of the Native CDFI Network. (Courtesy photo)Pete Upton, chair and interim executive director of the Native CDFI Network board of directors and executive director of the Grand Island, Neb.-based Native360 Loan Fund Inc., said the increased funding came after years of consistent advocacy about the needs in Indian Country, and the effectiveness of Native CDFIs.

Pete Upton, chair and interim director of the Native CDFI Network. (Courtesy photo)Pete Upton, chair and interim executive director of the Native CDFI Network board of directors and executive director of the Grand Island, Neb.-based Native360 Loan Fund Inc., said the increased funding came after years of consistent advocacy about the needs in Indian Country, and the effectiveness of Native CDFIs.

“A 30 percent increase is pretty significant,” Upton (Ponca) told Tribal Business News. “It was really a huge win for the Native CDFIs.”

Want more news like this? Get the free weekly newsletter.

While Upton and his colleagues were pleased with the forward movement in the allocation, they’re also quick to point out that the $21.5 million in funding still fails to meet the growing need for funding. An earlier version of the omnibus bill included $27.5 million in funding for NACA.

“We pushed hard for that and we’ll continue to push hard for an ask of $30 million to $50 million that adequately supports the needs for Native CDFIs. This is a nice increase, but it really significantly has to be more,” Upton said.

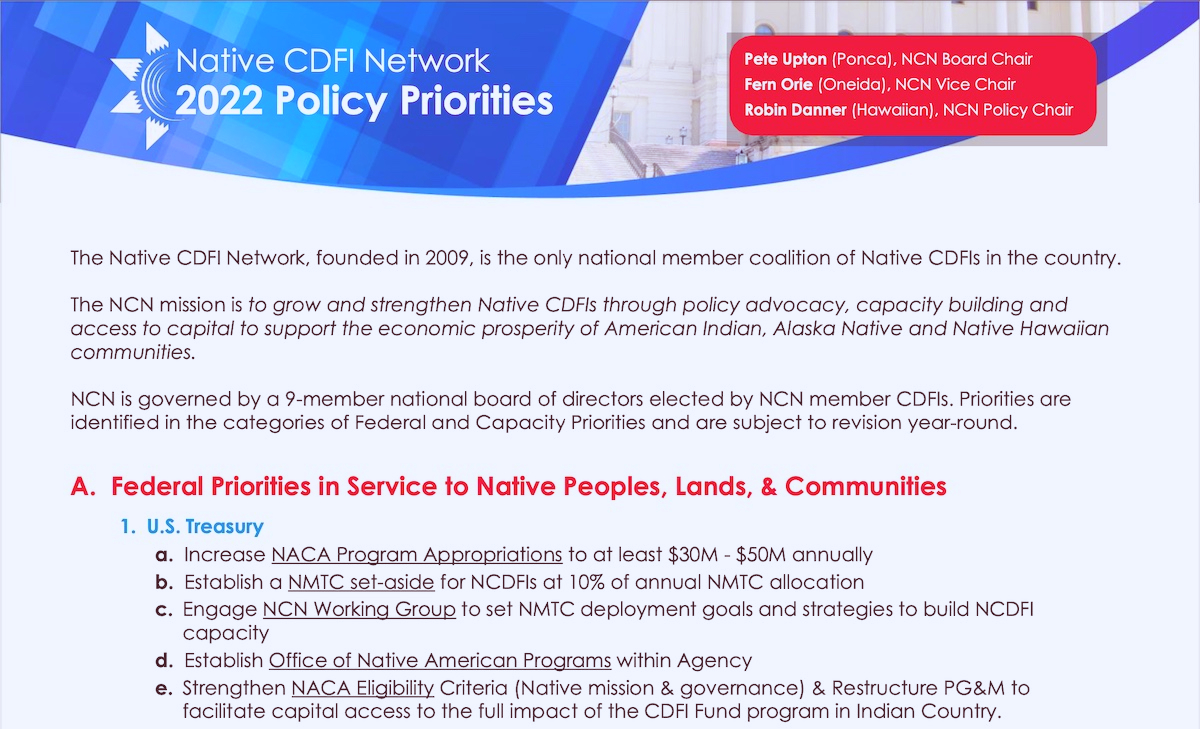

Securing adequate funding for the NACA program stands as one of the top priorities for the Native CDFI Network, which released its 2022 policy priorities on Friday. The organization’s Policy Committee devised the list following a mid-February roundtable meeting in Washington, D.C., its first in-person meeting in two years.

Robin Puanani Danner, the chair of the Policy Committee and executive director of the Anahola, Hawaii-based Homestead Community Development Corp., said Native CDFIs are too important to local and rural economies to remain invisible to federal agencies, banks and philanthropic donors. The Policy Committee believes that increasing the visibility of Native CDFIs will help in demonstrating the need to properly fund them, she said.

Danner, a Native Hawaiian from the island of Kauai, cited the pandemic-related funding boosts last year as an example. While Native CDFIs also received a funding boost, their increase fell off the pace of the overall increase in funding for CDFIs nationally.

Robin Puanani Danner, executive director of Homestead Community Development Corporation. (Courtesy photo)“The Congress and the administration did an outstanding job of moving big investment dollars into the hands of CDFIs nationally, but failed to adequately up-fund the Native program,” Danner told Tribal Business News.

Robin Puanani Danner, executive director of Homestead Community Development Corporation. (Courtesy photo)“The Congress and the administration did an outstanding job of moving big investment dollars into the hands of CDFIs nationally, but failed to adequately up-fund the Native program,” Danner told Tribal Business News.

She said this year’s NACA increase “made me optimistic, but it also let all of us realize that we have got to make Congress and the administration know that they’re missing out by the invisibility of the Native CDFI industry among the larger CDFI program. We’re key, especially to rural areas of the country and rural states.

“Our belief is that Native CDFIs and this industry is perhaps too invisible, but getting better, and is an important piece of the economic recovery of not just our tribal communities but of the 27 states that we’re in, and the economic recovery of the country. Every single (Native CDFI) is flowing capital directly into the hands of Native American citizens who then employ every kind of citizen.”

Other federal policy priorities for the Native CDFI Network include:

- establishing a 10 percent Native set-aside in the Treasury Department’s New Markets Tax Credits program, where Native community development entities have been successful in securing only a fraction of a percent of the credits over the last four years.

- creating a 10 percent set-aside in the HUD Section 4 funding in tribal areas, which Danner argues would help strengthen the economic recovery across a wide swath of rural communities.

- ending redlining in home loan originations in Native communities.

- implementing a partnership between Native CDFIs and the Interior Department to provide financial literacy training in schools run by the Bureau of Indian Affairs, as well as to support the Office of Indian Economic Development and business-focused programs within the BIA

- waiving matching requirements in the administration’s Build Back Better initiatives to better allow Native communities to participate.

Additionally, Native CDFI Network wants to ensure that a host of federal agencies and boards engage with the organization so that Native communities are better served by the myriad federal programs available to them. The group’s underlying goal is to avoid the “missed opportunities” that happen in Indian Country when Native peoples lack a seat at the table in designing and implementing federal programs and policies, Danner said.

“Get more Native voices at the table speaking for Native issues,” Upton said.

In particular, Native CDFI Network is calling for the creation of an Office of Native American Programs within the Department of the Treasury, which oversees the CDFI Fund that determines how the NACA program is distributed to Native CDFIs.

“We need Treasury to recognize that we’re not just another minority or racial group. We’re beyond race. We’re an obligation of the country — the three Native peoples — and that’s not just the BIA or the Department of the Interior, it’s the entire federal government,” Danner said. “By fulfilling that obligation, everybody wins. We are staunchly a part of the economic recovery.”

Another priority calls on the Small Business Administration to consult with Native CDFIs to replicate the engagement they’ve had within the Community Navigator Pilot Program, as well as to make the initiative a permanent program.

The Native CDFI Danner leads is a participant in the pilot, which has given her hope that the SBA will continue to find ways to support the kinds of microbusinesses common in Indian Country and give them opportunities to scale up and grow.

Other priorities outlined by the Policy Committee focus on growing engagement with the philanthropic community, building capacity to improve a broad array of Native-serving programs and driving collaboration and partnerships between various Native intermediaries.

At the end of the day, Danner thinks Native CDFI Network’s track record and the current national environment will work in the group’s favor as it seeks to execute on its policy agenda.

“We don’t want to be the afterthought,” Danner said. “The non-Native world and the investment community and the philanthropic community are going to find out that, ‘Wow, why weren’t we doing this sooner?’ That would make my heart sing to know that the next generation of Native CDFI leaders will have a very bright future.”